4.0 minute read

September 14, 2015

In a recent Court of Appeals decision, the City of San Clemente is being required to refund approximately $10.5 million of its unexpended Beach Parking Impact Parking Fees. This is the largest impact fee refund that has ever been required as a result of a lawsuit related to the Mitigation Fee Act (Gov Code 6600 et seq.) often referred to as AB1600.

Development Impact Fee Process: An Overview

The California legislature passed AB1600 which established the procedures to be used by public agencies to exact or impose fees on new development in order to offset the impacts they have on a community. Under AB1600, prior to the adoption of any impact fee on new development, an agency must:

- Identify the purpose of the fee;

- Identify how the fee is to be used;

- Determine how a reasonable relationship exists between the fee’s use and the type of development project on which the fee is imposed; and

- Determine how a reasonable relationship exists between the need for the public facility and the type of development project on which the fee is imposed.

In addition, when a fee is imposed on a specific project, the agency must also demonstrate a reasonable relationship between the amount of the fee and the cost of the public facility, or the portion of the public facility attributable to the development on which the fee is imposed.

Many agencies use their Capital Improvement Plan (CIP) to identify the specific facilities that will be needed to support future growth and to identify when those facilities will be needed based upon projected growth. CIPs typically consist of a mix of projects, including those needed to replace facilities that have reached the end of their useful life, new facilities to provide enhanced services to the community, as well as new facilities to serve projected growth. Often, individual CIP projects are related to several of these factors. Because of this, it is important to carefully allocate cost among existing and future development within the CIP.

AB1600 Requirements

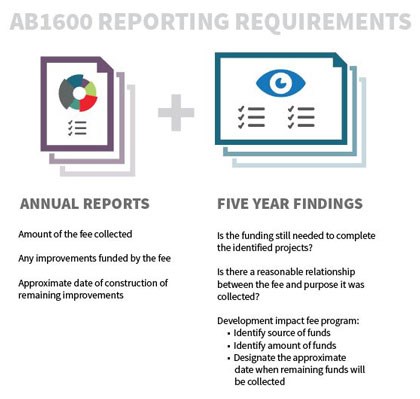

Following the adoption of a development impact fee, AB1600 requires that the agency annually report on the amount of the fee collected, any improvements that were funded by the fee and the approximate date by which the construction of remaining improvements will begin. In addition, AB1600 also requires that every five years following collection of the first fees, an agency must make findings that:

- the funds collected are still needed to complete the identified projects, and

- there is a reasonable relationship between the fee and purpose for which it was collected.

The agency must also identify the source and amount of funds that will be needed to complete any projects that were identified in the development impact fee program and designate the approximate date upon which it is anticipated that the remaining funds will be collected.

This requirement to make these findings every five years is important, since AB1600 requires that if these findings are not made, any unexpended funds must be refunded. In addition, AB1600 also requires that once sufficient funds have been collected for a project, the agency has 180 days to identify the estimated date that construction will begin. The failure to do so may also result in the agency being required to return any unexpended funds.

Walker v. City of San Clemente

In the case of the City of San Clemente, the City adopted a Beach Parking Impact Fee in the late 1980s based upon concerns that new development was creating an increased demand for access to beach parking, and that there would be a need to construct new parking facilities as a result. The City collected nearly $10 million between 1989 and 2009, and only spent a very small portion of the fees that it collected. While the City did provide reports in 2004 and 2009 regarding the status of the funds that were collected, the Court found that those reports did not satisfy AB1600’s requirements for five-year accounting, and that the City could not rely on findings supporting the original adoption of the fee or the findings that it made over 13 years ago when it originally adopted the fee. As a result the Court ruled that the City must refund all of its unexpended Beach Parking Impact Fees.

In light of this recent case, every agency that collects development impact fees should review its reporting and accounting practices to verify that they are complying with the specific requirements of the Mitigation Fee Act, which requires the agency to make new findings every five years and to demonstrate a continuing need for any unexpended fees.