4.0 minute read

January 04, 2016

We should be proud that Washington State is among the first eight states to approve a recurring revenue package in the interest of improving transportation infrastructure with critical funding needs.

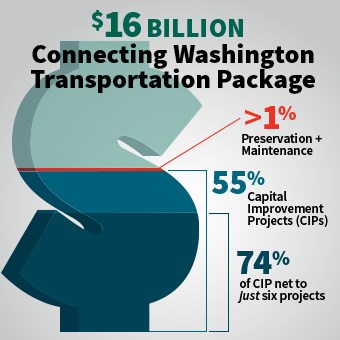

Unfortunately, the priorities are backward in the $16 billion Connecting Washington Transportation Package, which includes a new gas tax increase. I shudder to think that we’re creating a deeper hole for future generations, both in debt service and ignorance of pavement preservation and restoration.

In Part 1 of this blog discussion, I looked at how the gas tax fits into transportation spending. In this post, I dive into the allocation of funds toward new projects versus preserving the current infrastructure.

Why This Investment Matters

Washington’s economy depends more heavily on trade than any other state in the U.S., and requires a reliable infrastructure system for effective freight mobility.

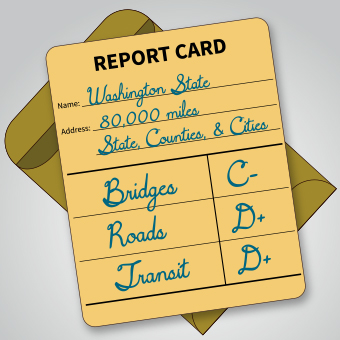

What the system lacks is a solid strategy for continuous preservation and maintenance, because our 80,000 miles of state highways, county roads and city streets are on the verge of deteriorating. Our infrastructure graded poorly in a recent American Society of Civil Engineers Report Card: C- for bridges, D+ for roads and D+ for transit. These marks show that Washington has a lack of planned, guaranteed funding and inadequate maintenance across the board.

Cities and counties own over 60% of the road miles, making local agencies crucial to preserving aging infrastructure. (The majority was built 45 to 65 years ago and is nearing the end of its useful life.) However, agencies’ efforts won’t be supported nearly enough over the 16-year life of the revenue package: it only distributes 3% to cities and counties, snubs their maintenance needs and promises to increase debt service for Washington residents.

Neglecting the Old in Favor of the New

It’s rarely a good move to ignore expert advice. But that’s exactly what’s happening here.

The Washington State Transportation Commission (WSTC) offers policy guidance and recommendations to the governor and legislature. Its 2015 Revenue Proposal urged that 48% of the new funds be allocated to preservation and maintenance:

“While the state has invested significantly in system improvements over the last 10 years, we have fallen behind in maintaining and preserving the existing transportation system….of this $21B [actually $16 billion in the final package], Connecting Washington Task Force targeted $10B for maintenance, preservation, and operations for the state, county, and cities and transit….”

Yet the final package allocated less than 1% for preservation and maintenance, while Capital Improvement Projects (CIPs) will consume 55% of the package.

There’s more startling news: CIPs consume 74% of that 55% CIP budget for just six major projects along I-5, I-90 and I-405, leaving only $2.5 billion for other WSDOT and local road construction and replacement projects.

Here's a quote from the Washington Transportation Plan 2035, a document prepared by WSTC, WSDOT, the state’s Metropolitan Planning Organizations and Regional Transportation Planning Organizations that provides guidance and recommendations for the state transportation system:

"Several very significant capital expansion and replacement projects are underway, promising to improve future mobility in critical corridors, but also consuming a large percentage of available funding and financing capacity. Generally, there is insufficient funding available to address both known and unanticipated future transportation needs, as too large a percentage of authorized funding streams are committed to specific projects/programs and to debt services."

This explains why I'm crying into my coffee.

With existing infrastructure slipping further into disrepair, we’ll be slipping further into debt, without a thorough analysis of whether pay-as-you-go financing would be a prudent option. Instead, 18% ($2.9 billion) of the new package will pay interest and principal on already-built projects, and the law allows for new debt services of $5.3 billion. The result: about 70% of net fuel tax revenue prior to this package will stay devoted to long-term debt, an estimated $4.1 billion of just interest for the next 30 years.

Will this plan plunge the state into the deepest debt in our history? A debt that will eat up interest payments for decades and limit funding desperately needed for existing roads and transit projects? I’m concerned that these may be the results unless we act now and take a different approach.

In my next post (Gas Tax Part 3), I will discuss changing the fabric of our thoughts and adopting a cultural shift that others around the world are using to better address their transportation needs. In the meantime, let me know your thoughts about the transportation package as it stands today.